Colorado Estate Tax 2025

Colorado Estate Tax 2025. The relief to homeowners is to lower the assessment. Colorado estate tax is applied to the entire estate.

Most simple estates, such as cash or a small amount of easily valued assets, do not require the filing of an estate tax return. In this video, we’re going to talk about what estate taxes are and we’ll dig into the basics of colorado estate taxes.we’ll also show you different tax plann.

2025 Gift And Estate Tax Update.

Colorado estate tax is applied to the entire estate.

This Means You Can Gift Up To $18,000 To As Many People As.

The estate taxes are not paid by a beneficiary as they typically are with an inheritance tax.

It Takes An Average Time Of 6 To 12 Months To Sell An Inherited Property, Depending On The Probate Process.

Images References :

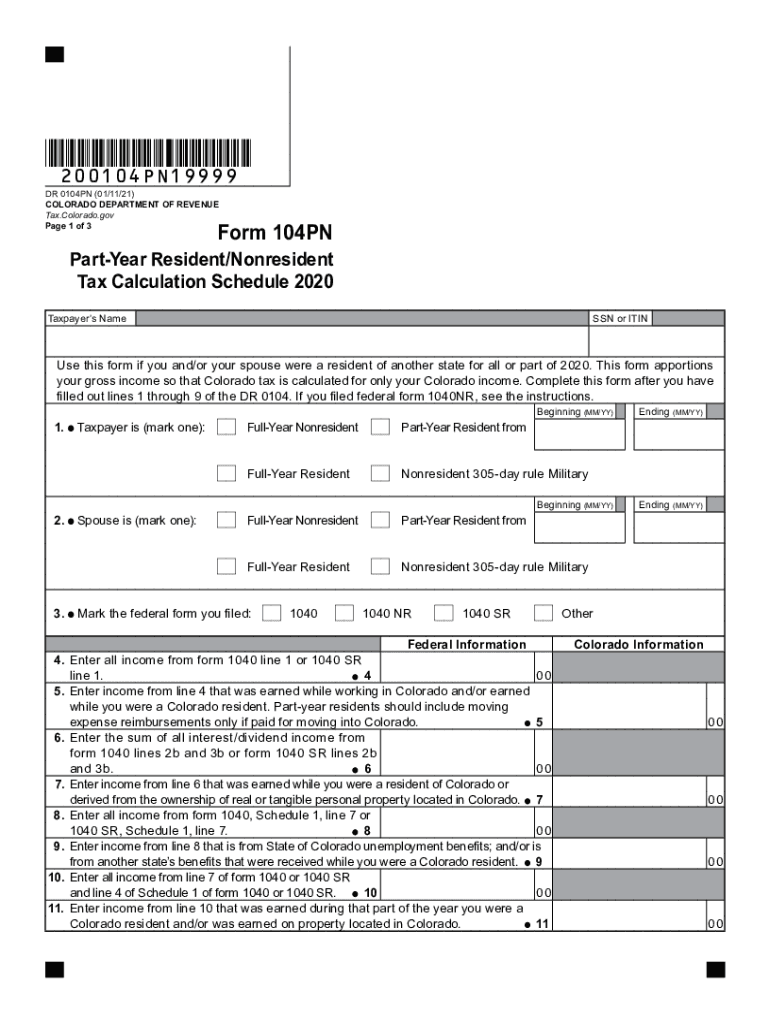

Source: www.dochub.com

Source: www.dochub.com

Colorado form 104pn Fill out & sign online DocHub, Colorado gift tax and inheritance tax. Even though there is no estate tax in colorado, you may still owe the federal estate tax.

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2025 Fannie Stephanie, As of 2021, the threshold for the colorado estate tax is $2.8 million. Estates below this value are not subject to federal estate taxes, making.

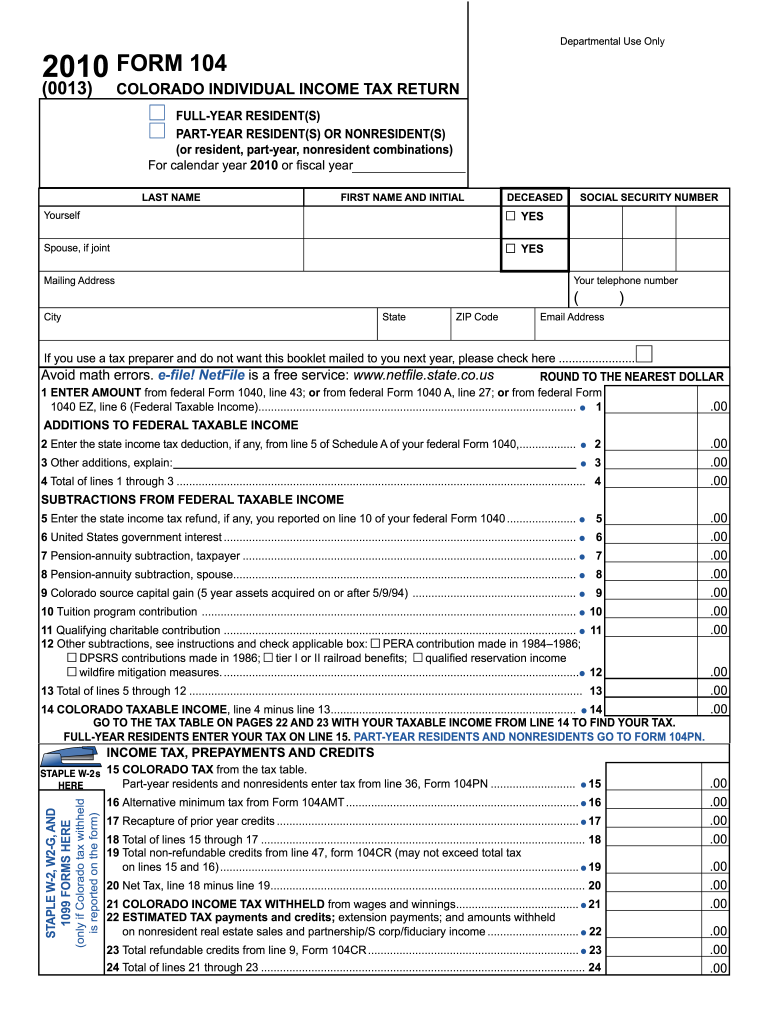

Source: www.dochub.com

Source: www.dochub.com

Colorado form 104 Fill out & sign online DocHub, It takes an average time of 6 to 12 months to sell an inherited property, depending on the probate process. That means that if the right legal steps are.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, What is the inheritance tax in colorado? Even though there is no estate tax in colorado, you may still owe the federal estate tax.

Source: willianunesweb.blogspot.com

Source: willianunesweb.blogspot.com

colorado estate tax form Allie Belton, As of 2021, the threshold for the colorado estate tax is $2.8 million. How to avoid inheritance tax in a state where an.

Source: tiffaniewmegen.pages.dev

Source: tiffaniewmegen.pages.dev

2025 Tax Brackets Mfj Limits Brook Collete, This tax is portable for married couples. It's also important to understand that estate tax exemptions can change over time.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Hansen told colorado politics tuesday that the bill will provide property tax relief to homeowners and renters. What is an estate tax and how does it work?

Source: rockstar-onthego.blogspot.com

Source: rockstar-onthego.blogspot.com

colorado estate tax rate Queen Dozier, In this video, we're going to talk about what estate taxes are and we'll dig into the basics of colorado estate taxes.we’ll also show you different tax plann. As of 2021, the threshold for the colorado estate tax is $2.8 million.

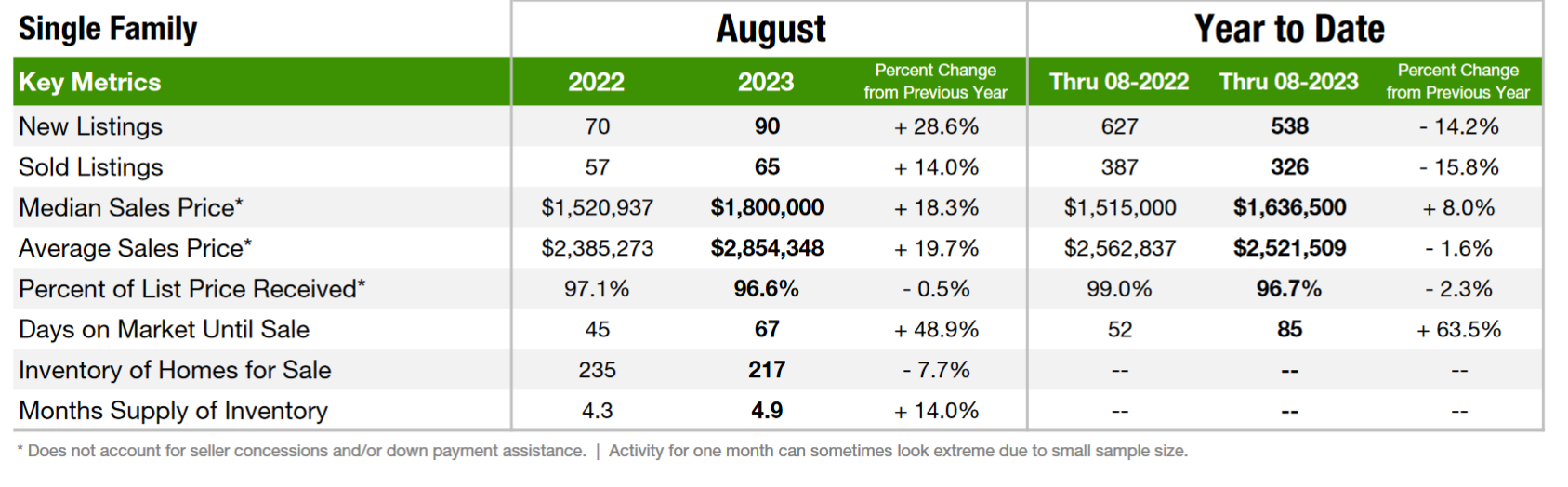

Source: coloradosun.com

Source: coloradosun.com

Colorado property tax calculator How the relief plan would affect your, There are two application forms for the senior property tax exemption. It's also important to understand that estate tax exemptions can change over time.

Source: coloradohardmoney.com

Source: coloradohardmoney.com

Real Colorado property tax reduction on the ballot in 2025 Colorado, Colorado offers an automatic six. 2025 gift and estate tax update.

What Is The Inheritance Tax In Colorado?

2025 gift and estate tax update.

Colorado Gift Tax And Inheritance Tax.

Of the assessor’s office’s 214 employees, most of whom work four days a week, 15 have filed notices informing the county of outside work, ranging from working as a real.